Residential real estate: performance turnaround in A, B, C and D cities

Since the analysts at Bulwiengesa first divided the German real estate market into A, B, C and D cities in 1996, a very strong narrative has developed: A-cities with low yields and high levels of security due to the glaring housing shortage, and B- and C-cities with higher yields but less market liquidity. In the 2010s, these became the "overheated A-cities" and the "emerging B- and C-cities," often called "swarm cities," while D-cities were often considered too unsafe and illiquid. However, these still omnipresent narratives should be questioned now at the latest.

Institutional Money.com | Markets |

Metropolises - premium locations available again for the first time

The purchase prices of residential real estate in Germany rose steadily up to 2022. This development was led by the seven German metropolises Berlin, Munich, Hamburg, Frankfurt am Main, Cologne, Stuttgart and Düsseldorf, in addition to a number of cities with strong growth, such as Leipzig and Dresden. As a result, the risk-return ratio deteriorated, as prices sometimes offered little room for improvement. Currently, we are seeing the opposite trend: even in the A-cities, purchase multiples fell and yields rose. Nevertheless, average multiples are still significantly higher than in smaller markets.

Overall, the metropolitan areas achieved fundamentally positive results in the survey: Frankfurt am Main is the best-placed metropolis, ranking fourth out of all 111 cities surveyed. It is followed by Munich in sixth place and Stuttgart in tenth. Düsseldorf is the "taillight" of the A cities, ranking 22nd, although the top grade A++ was also awarded there. A new development on the markets, on the other hand, is that multifamily properties are now also available in premium locations such as Munich-Schwabing, in Cologne's Südstadt district and also in Frankfurt's Westend - something that was very rarely the case in the past. This means that professional investors can now carry out targeted transactions. The still high level of market liquidity also facilitates investment projects in this regard.

Leipzig, Darmstadt and Potsdam lead the way

The ranking is led by the cities of Leipzig, Darmstadt and Potsdam, i.e. three locations with different populations and characteristics. The swarm city of Leipzig, which is unofficially regarded as the "eighth A-city," thus differs once again from the metropolises in its market development. Leipzig is characterized by the lowest possible location risk, which equates to the highest market attractiveness for residential investments.

Overall, some second- and third-tier investment locations, such as Hanau, Ulm and also Pforzheim, are in a rather positive position in terms of achievable returns. Cities such as Worms, Leverkusen and Hamm can be considered hidden champions: Although market security in these locations tends to be in the midfield, the above-average returns offer potential. Particularly in a financing environment in which interest rates can be around four percent, these high yield levels also provide a buffer in view of any additional investments that may be required..

Rental price growth supports markets - and leads to evasive action

An important factor shaping the market is the continuing tight rental market, both in the metropolises and in the growth cities. In combination with little new construction and high demand, rents are expected to rise in the future. Against the background of the price correction, this is a very interesting investment environment. In the new-build segment in particular, indexed leases, which offer a high degree of inflation protection, are also becoming increasingly common. Accordingly, on balance, the new construction segment offers a somewhat better risk/return ratio than the existing property segment. This is also the case from an energy perspective, as new-build properties already meet high standards and will not require energy upgrades in the foreseeable future.

However, the steadily rising asking rents have another decisive effect. In metropolitan areas in particular, they ensure that a considerable proportion of household income is accounted for by the basic rent. As a result, more and more people are opting to move to affordable, smaller but attractive cities. Also in view of flex office models, not only Speck belts are likely to grow more strongly than core cities in the future, but also well-connected cities such as Erfurt. From a risk/return perspective, this is likely to lead to a positive development, especially since, on balance, too few new buildings can be built in small and medium-sized cities to meet demand in the long term.

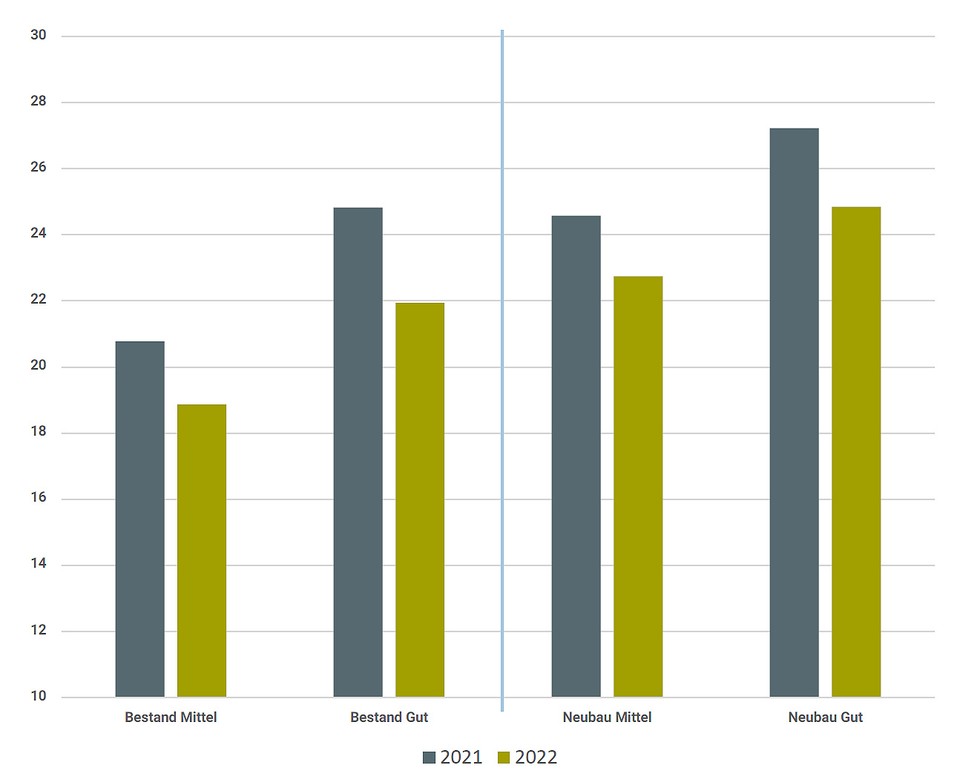

Chart: Purchase multiples for multi-family houses in Germany by location quality

After more than 10 years of rising multiples, a trend reversal occurred in 2022

(Average of the 111 most important residential real estate markets | Source: Lübke Kelber Research)

The question of ownership has implications for institutional investors

Our study has also brought to light another trend that currently affects mainly private real estate purchases, but which could have a decisive impact on institutional investments in the future: For the first time in a long time, the ongoing burden in 110 of the 111 cities surveyed is higher for a purchase of a condominium than for renting, assuming a debt ratio of 80 percent. The more expensive the respective metropolis or micro-location, the wider this gap. This development is therefore relevant for institutional investors, as rental apartments are likely to be in even greater demand in the relevant locations.

Attractive investment opportunities despite higher interest rates

There is no question about it: The interplay of the numerous factors mentioned above means that the markets are currently much more complex than they were just a few years ago. Despite this fact and despite the high level of interest rates, potential buyers with sufficient equity should not feel deterred. In fact, the current market offers an interesting environment of a tight rental market with growth potential and now lower, more sustainable purchase prices. In addition, we see a diverse and broad supply side with potential properties in second-tier cities to multifamily properties in absolute premium locations that have been scarcely available, if at all, in the past five to ten years. In perspective, this should lead to the current price dip being overcome and a positive change in value yield being recorded in the medium to long term.

Contact: mark.holz@luebke-kelber.de | marc.sahling@luebke-kelber.de

Link to the article: Where residential investments are still worthwhile now | Markets | 08.05.2023 | Institutional Money (institutional-money.com)

Download: Risk and Return Ranking 2023