#02 Retail-Renaissance

There is a coherent chain of reasoning why high-street retail in small and medium-sized cities is likely to experience a renaissance and outperform the large metropolises. This would be the reversal of a 25-year trend.

As with the decline of this market segment, structural developments, especially demographics, migration and new work, are the basis of this thesis. A promising investment strategy can therefore be to focus on high-street units in small and medium-sized cities - especially if one does not buy individual buildings in small sections, but successively entire streets. Admittedly, this can be a lengthy and laborious process due to the small-scale ownership structure.

A look back

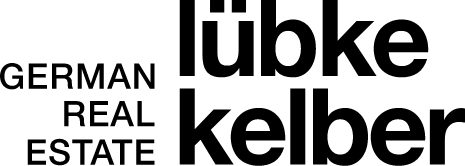

Let's first look at how retail has developed in the past. The analysis of prime rents in high-street retail shows that the A-markets in particular experienced a period of almost uninterrupted growth in the last 20 years up to 2017. This is remarkable against the backdrop that we had two drastic economic crises with both "dot.com" and the "Great Financial Crisis" (GFC). Here, the A-markets in particular were quite unimpressed.

This means that the performance in the retail sector was mainly structural and less cyclical. Drivers of the boom were, among other things, the festivalisation of retail and the associated focus of retailers on the best spaces. At the same time, the decades after 2000 were marked by a massive globalisation of retail: there were many international entries into Germany. And these retailers wanted to establish their flagship stores in the best locations for advertising purposes. These trends did not take hold in the smaller towns, or even had the opposite character, because the experience function was much less pronounced than in the top shopping streets. In combination with weaker population growth, this meant that retail in small and medium-sized towns had to deal with major challenges, which in many cases led to a banalisation of the retail structure as well as increased vacancies.

With the massive growth of e-commerce, which became relevant from around 2010, these (continuing) trends now experienced a clearly opposite and very formative development. As a consequence, top rents stagnated from 2016 onwards despite the economic boom and fell in the coming years. [1] The often cited argument that the high rental costs, which were often not covered by sales in the retail space, are booked against the marketing budget, was no longer valid.

Chart 1: Prime retail rents (index, 2000=100)

Source: Riwis, bulwiengesa, Lübke Kelber Research

In general, rental development outside the large centres was significantly weaker - precisely because these locations did not benefit to the same extent from the drivers described above. It should be noted that chart 1 here shows the actual performance of the smaller cities even better than it actually was. This is because it only shows the prime rents, i.e. the best part of the market, but not the increased vacancy rates, for example.

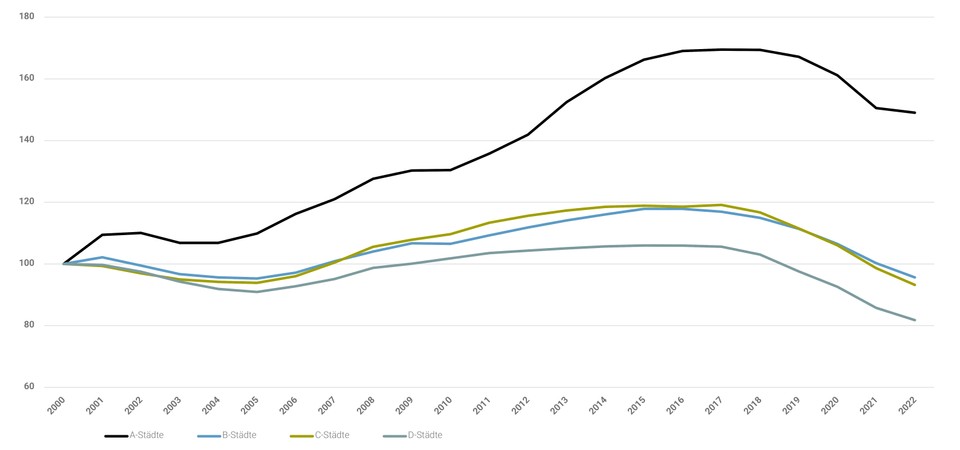

From an investment perspective, retail proved to be extremely lucrative over many years. A look at the total returns of the various real estate segments (chart 2) shows that over a holding period of ten years up to and including 2018, retail was almost consistently the outperforming sector. In recent years, however, it has been far outpaced by office and industrial (logistics and light industrial). Over the past 20 years, the performance of A-market retail properties has been 8% p.a., significantly higher than B (6.4%), C (6.5%) and D (6.1%) markets.

Chart 2: Average total returns of the A cities over 10 years to... (in %)

Source: Riwis, bulwiengesa; Lübke Kelber Research

Looking ahead: And all that is changing now?

A change is currently underway here on various levels.

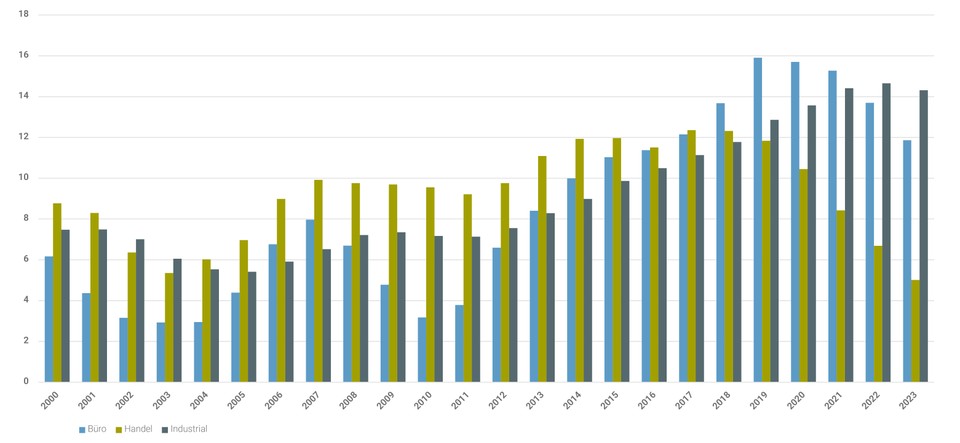

On the one hand, the retail sector has developed unnoticed into the strongest performing commercial real estate sector in recent quarters, in what is certainly a weak market. According to MSCI's analysis, the total return for retail real estate in Europe in Q2 2023 was the strongest at 0.4% (chart 3).

Chart 3: European total returns by sector in %.

Source: MSCI, European Commercial Property Returns

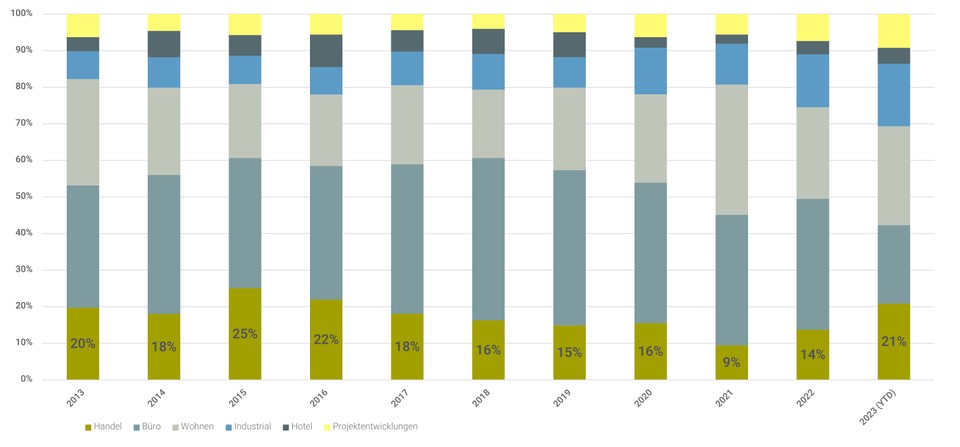

On the other hand, retail investments in Germany are now once again playing a much more significant role. The retail share of the transaction volume has risen from 9% in 2021 to 21% - the highest share since 2016. This is certainly also due to special effects such as the Slate - x+bricks transaction with a volume of just over €1 billion.

Chart 4: Share of German transaction volume*

Source: MSCI, Lübke Kelber Research

Here they come: Internal migration as a driver for small and medium-sized cities

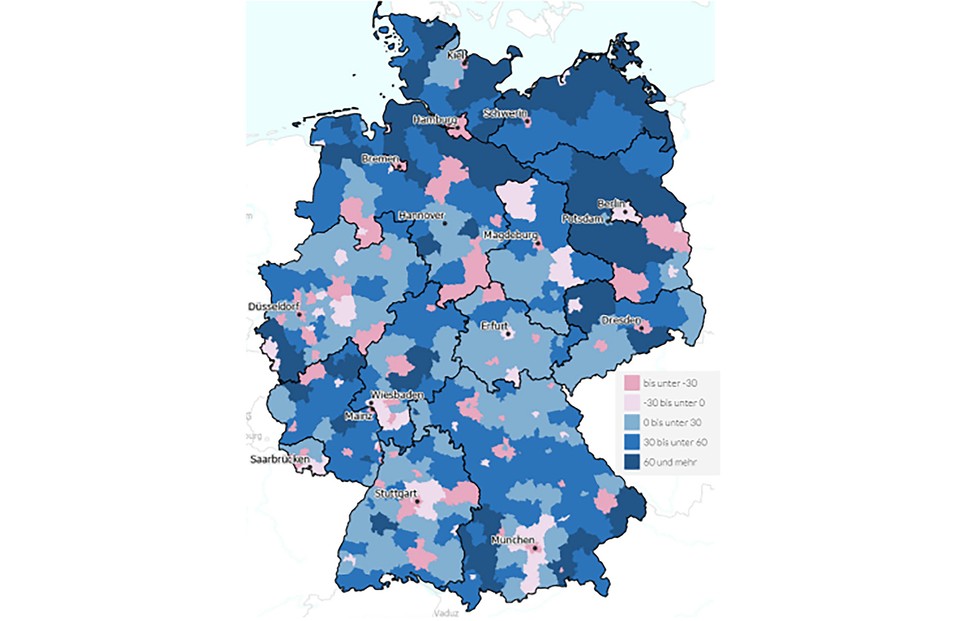

In the longer term and looking ahead, migration in particular will strengthen the performance of second- and third-tier trade in cities. For several years now, internal migration in Germany has been negative in the major metropolises (Map 1), while surrounding communities and nearby secondary cities are gaining.

Map 1: Internal migration within Germany: Balance of internal migration in 10,000 PE (2021)

Source: BBSR

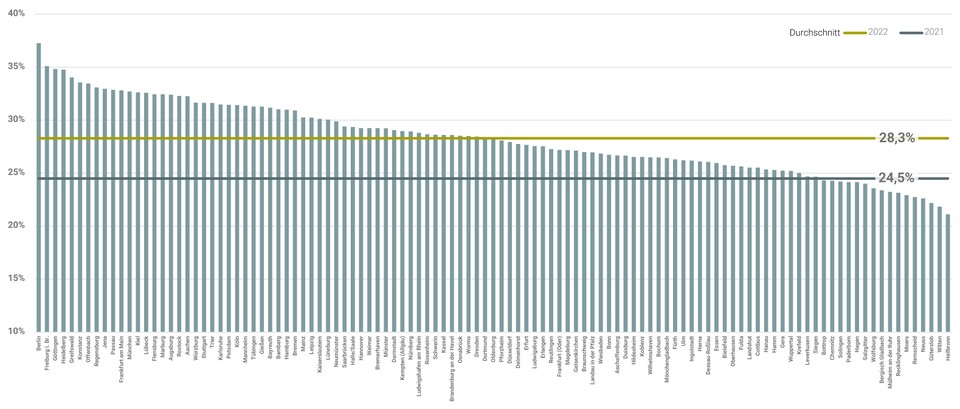

The reasons for this are the high rents, which lead to high encumbrance ratios (chart 5), but also the extreme housing shortage. While the average vacancy rate of German municipalities is 2.6%, the average of the top 7 is 0.7%, with Munich being particularly dramatic at 0.2%.

Figure 5: Burden ratios when renting a flat in % of household income

Source: Lübke Kelber Research

This trend has been exacerbated by the COVID-19 pandemic for several reasons. Firstly, because the lockdowns brought with them a need for more space and a yearning for the countryside. This is a trend that is also exacerbated by increasing ecological awareness. A recent study by the Technical University of Darmstadt [2], for example, shows that sustainability and "living in the green" is a main criterion of current housing demand. This is a circumstance that is often easier to realise in smaller, less dense cities than in the large metropolises.

On the other hand, COVID-19 has led to a significant increase in flexibility in many occupations due to the possibilities of remote work. This brings with it an increasing independence from the place of work and the place of residence. So you no longer necessarily have to live where you work. The lower the presence in the office, the higher the travel times one can theoretically accept. This circumstance should reinforce the internal migration trend described above and also extend it geographically.

All in all, these factors suggest that population growth in attractive and affordable second- and third-tier cities will be more dynamic over the next few years than in the big metropolises.

And this is relevant for the retail sector?

An increasing population, especially of population cohorts with higher purchasing power, should accordingly have a positive impact on high-street retail in the respective markets.

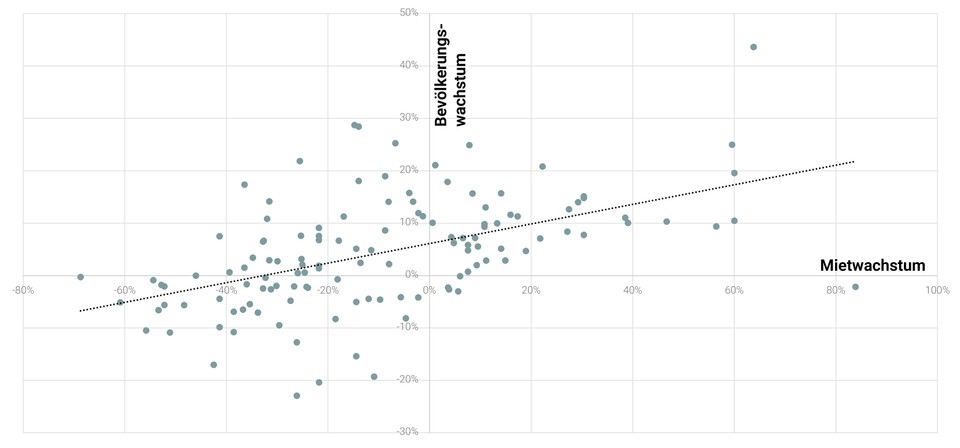

A correlation analysis of population development and retail rent development in the different cities confirms this assessment. Although the interaction is not perfect, with a correlation of 0.51 it is certainly statistically relevant. Thus, the set of markets with falling rents was dominated in the past by cities with declining populations, while rising rents were realised predominantly in cities with population growth.

Figure 6: Population growth and peak rent growth in retail (A, B, C, and D markets, 2000-2022)

Source: Riwis, bulwiengesa; Destatis; Lübke Kelber Research

Against this background - and based on the expected dynamic population development in attractive and affordable cities - it is precisely those cities in the second and third tier that should experience a disproportionately positive development in retail in the future. The retail properties and the rental development of these markets should develop more positively than those of the large metropolises. This would be the reversal of a 25-year trend.

Highstreet investment approach: growth prospects with low factors

From an investor's point of view, the expected renaissance of retail in small and medium-sized cities offers attractive approaches. This is because here the purchase factors have fallen to a low level due to the adverse environment in the last 10 to 20 years. They are not infrequently in the region of 10 times, which corresponds to a purchase yield of 10 %. With expected rent increases in attractive and affordable markets, disproportionately high total returns can therefore be expected.

As explained above, structural and long-term factors in particular were responsible for the performance of retail properties. Nevertheless, cyclical and short-term developments must be taken into account. Here, the situation in retail in general remains challenging. This is because both the continuing phase of economic weakness [3] and the persistently high inflationary structure are having a dampening effect on retail sales [4]. Cyclically, therefore, risks remain, while structurally and in the long term there are opportunities where they may not have existed in the form in the past. Decisive and deep micro and macro analysis therefore remains the key to success here.

Think big: Rounding off entire high-streets instead of individual assets

In order to meet modern consumer demands on retail and thus also to generate maximum performance from the investments, an "adventurous" approach is recommended, at least in theory: instead of buying many small buildings in different cities, the focus should be on the successive acquisition of entire shopping streets.

This is how holistic asset management and a holistic leasing strategy can be guaranteed. Similar to classic centre management, it is not the leasing success of an individual unit that is important here, but rather the concept and structure of the entire ensemble. Here, a target group-oriented overall offer can be mapped, which provides the best experience for consumers and thus the most sustainable result for the investor.

The approach certainly also involves a higher risk, especially if the "wrong" city or micro-location is chosen, and it is also a lengthy process due to the small-scale nature of the existing ownership structure. However, there are (international) examples such as Shaftesbury PLC that successfully implement just such a concept.

(1) Reinforced by the COVID-19 restrictions from 2021, of course.

(2) Pfnür et al, Ecological Sustainability as a Driver of Housing Transformation in Germany - Empirical Study of Private Households. In: Working Papers on Real Estate Research and Practice, Vol. No. 45, July 2022.

(3) The IMF expects GDP to decline by 0.5% in the current year and to increase modestly by 0.9% in 2024. imf.org/en/Countries/DEU

(4) For the period January to August, Destatis shows an increase in nominal retail sales of 3.1 %, but a real, inflation-adjusted decline of 3.8 %. Internet and mail-order sales even fell by 4 % in real terms. Retail sales in August 2023 1.2% lower than in previous month - Federal Statistical Office (destatis.de)

* Entity and M&A transactions are excluded