#01 Ladies and Gentlemen, restart your Engines!

Last year, the year-end rally failed to materialize. Instead, the Real Estate Grand Prix was brought to a halt by a massive storm. The storm of geopolitical crisis and interest rate shock made for decidedly adverse conditions, causing some drivers to crash or run off the road, while others rallied behind the safety car or drove into the pit lane altogether. The storm is now largely over. The roads are clear again, although still very wet. Those who are now in the race with a full tank of gas, the right tires and the right strategy can drive home a lot of points for their team.

Bottom formation

To end the formula one picture here: No, there will certainly not be a classic year-end rally as we have seen in the past 10+ years. However, the markets are now more calculable again as the interest rate rise cycle is coming to an end or is already at an end and thus the calculative uncertainty is decreasing. At the same time, interest rate-induced repricing in the professional/institutional market is largely complete and we are in the midst of bottoming out. Now that pricing is more sustainable, attractive investment opportunities can be identified with a correspondingly high equity ratio. However, the quality of the investment is much more dependent on fundamental supply and demand parameters as well as individual building specifics than in the past ten years.

Pricing

Since mid-2022, the investment market has rapidly changed from an overheated seller's market to a comparatively illiquid buyer's market. This is the result of the causal chain of the invasion of Ukraine, the subsequent price shock, and the massive interest rate hike with which the ECB countered. As a result, leveraged strategies in particular no longer worked out, and business plans for new investments only paid off with significantly higher purchase yields than a year or two earlier.

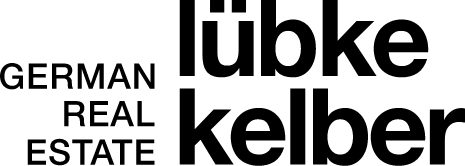

This development is strikingly illustrated in chart 1, where I have calculated for a theoretical example property the maximum purchase price per square meter that an investor can pay if she wants to achieve a certain distribution yield. The only factor I have adjusted in this calculation is the cost of financing.

Chart 1: Sensitivities example property: possible price per square meter with varying distribution yields and LTVs.

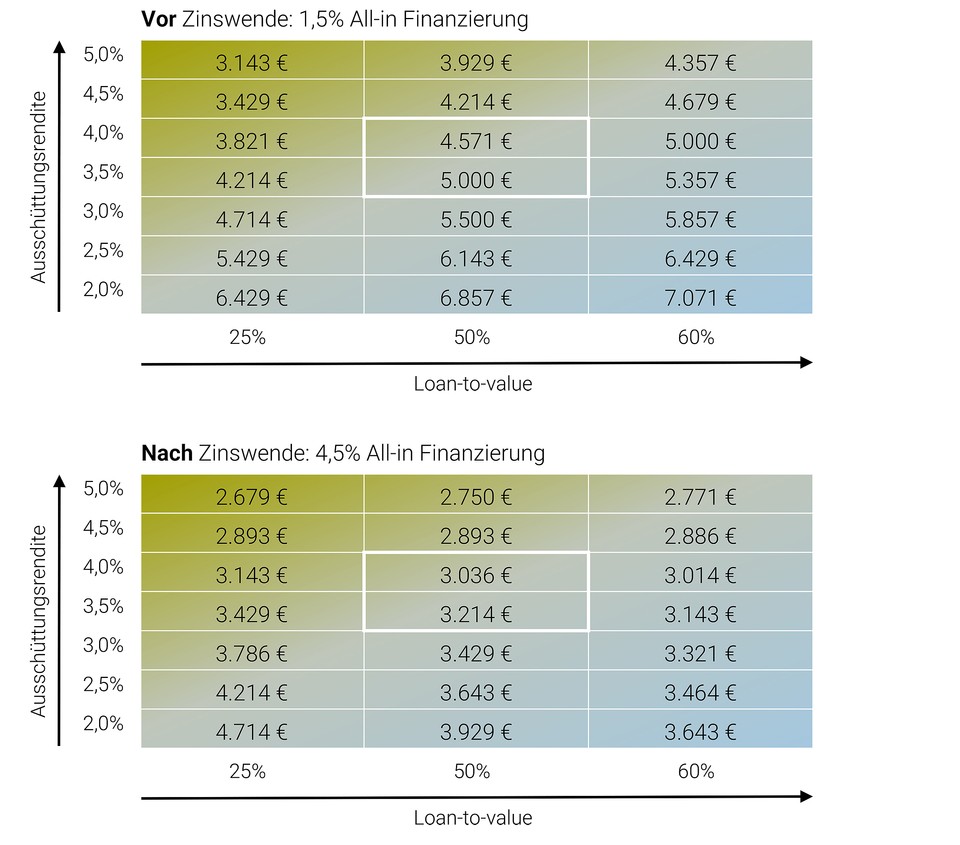

Accordingly, purchases were and are only made if a seller is prepared to match the maximum price that a buyer can pay. As a result, the purchase price factors that can be realized in the market have fallen significantly. In the residential real estate sector, a correction could be observed accordingly in 2022, which continued in the first half of 2023. We assume that the adjustment of factors in the market is thus largely complete for the various sectors. Welcome to the bottom formation!

Chart 2: Purchase multiplier spreads multifamily H1 2023; existing properties, medium location

Outlook: How is the environment developing?

So much for the status quo - the question remains: What will happen next? Because we can hardly draw on empirical values from the past for the current situation, the outlook is so difficult. Particularly with regard to the development of interest rates, forecasts currently diverge widely. Especially when it comes to the timing and speed of falling key interest rates.

Interest rate

With inflation rising, the ECB, like other central banks, has raised key interest rates massively in recent months to 4.5%, a level last seen in July 2008 and previously in 2000/2001. Accordingly, both the yield on government bonds and financing costs have risen.

Chart 3: Interest rate structure Germany 2022/2023

This development affected the real estate market both indirectly - through the increased relative attractiveness of the competing asset class of bonds - and directly - through higher financing costs.

The further development of interest rates remains difficult to assess and the forecasts of various specialists, analysis houses and banks diverge here. The consensus view is that key interest rates will remain at a level above 4% until mid-2024 and fall below 3.5% in early 2025. In view of the still - surprising to me - high inflation, this is an understandable outlook. Oxford Economics, on the other hand, expects a faster and more pronounced return to lower interest rates. Accordingly, interest rates are expected to be lowered as early as 2024 and settle at a level below 2% by the end of 2025. This view is also understandable against the background of the increasingly weakening macroeconomic situation.

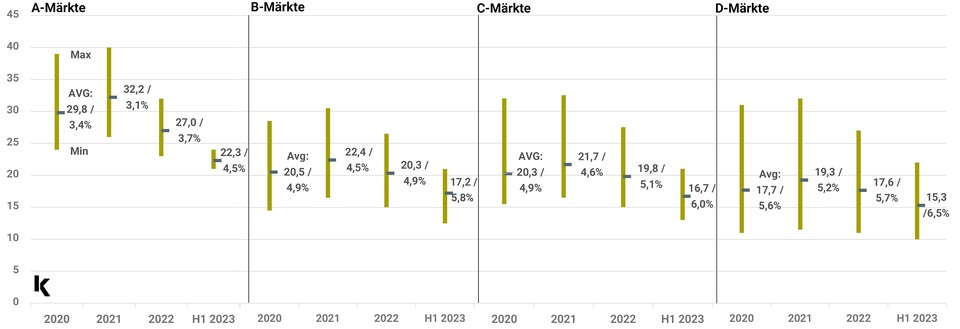

In any case, interest rates are expected to fall in the medium term, which in turn should have a positive impact on the momentum and performance of the real estate markets. Chart 4 shows a schematic relationship between the various parameters.

Chart 4: Schematic diagram: Interaction between interest rates and real estate values and implied investment strategies

Ceteris paribus, falling interest rates should ensure positive performance, as financing becomes more favorable, making properties more profitable at higher purchase factors. Such a development opens up opportunities for interesting investment approaches.

One approach is to currently buy properties at attractive purchase factors with a lot of equity or completely without financing and to finance them later at better conditions. This would not only result in a positive performance, but also in an increase of the current distribution due to a more positive leverage effect.

Another approach would be conceivable specifically in the residential real estate sector. Because with lower key interest rates and financing costs, the private ETW and house market should also open up again. In this case, a possible strategy would be to currently acquire multi-family houses or terraced house quarters and, when the private investment market picks up again, to strategically sell individual apartments or individual houses at a higher factor and thus generate a yield kicker.

The more pronounced the downward trend in interest rates, the more attractive these strategies should turn out to be.

Economy

Of course, interest rate developments are not the only market-determining factor. The macroeconomic environment and outlook have become increasingly gloomy over the past six to nine months. With negative GDP growth in Q4 22 and Q1 23, Germany was in a technical recession, which did not turn into growth even in Q2 23 at 0%. Leading indicators, such as the PMI1, the Consumer Climate Index2 or the OECD's Composite Leading Indicator3 remain at low levels and the economic growth outlooks of the major analysis houses have been adjusted downward for the current year and 2024. For 2023, most banks and economic institutes expect negative growth. The Bundesbank expects GDP to decline by 0.5% followed by a rather below-average increase of 1.2% in 2024, while Commerzbank even expects GDP to decline by 0.3%4 in 2024.

Rental Market Fundamentals

While interest rate developments have a particular impact on the capital market side of the real estate sector, the economic situation, on the other hand, is a key determinant of rental market dynamics - especially in the commercial real estate sector.

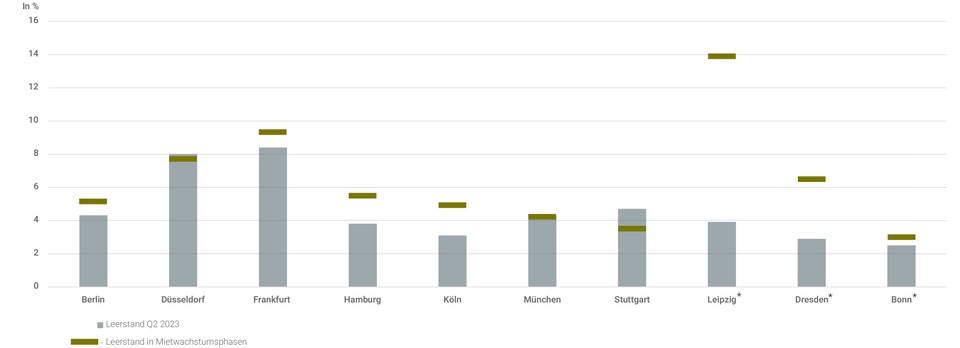

Against this backdrop, leasing activity is expected to be slow over the next 12 to 24 months, which is likely to have a dampening effect on rental growth. Vacancy rates in the office markets have already tended to rise in recent quarters, a trend which is likely to continue. However, this development must be viewed in a differentiated manner. On the one hand, vacancy rates in many locations remain at a low level, which means that further rental growth can be expected (see chart 5). On the other hand, demand for office space is itself heterogeneous. While modern, centrally located offices with flexible space layouts continue to see high demand, peripherally located and older office properties are experiencing lower demand.

Graph 5: Vacancy rates in rental growth phases compared with current levels

The residential real estate sector is less directly influenced by economic developments. The rental market is more sluggish and tends to react less sensitively to short-term cyclical developments. It would take a prolonged recession with associated rising unemployment and/or declining purchasing power to have a sustained negative impact on the residential real estate rental market.

What is currently driving the residential real estate sector is the continuing structural mismatch between supply and demand, especially in the economic and cultural metropolises and many university cities. This imbalance is unlikely to ease in the next two years, but is more likely to worsen, as the hard-to-digest cocktail of years of high land and construction costs, rapidly rising financing costs and a resettled buyers' market will lead to significantly fewer completions in the next 12 to 24 months.

Against this backdrop, it can be assumed that pressure on the rental market will not ease in the coming quarters and that residential rents will continue to rise. Given the level of rents in the major metropolitan areas, we expect the dynamics to shift and attractive and affordable second- and third-tier cities in particular to see disproportionate rental growth.

Ecological performance

Sustainability criteria have evolved in recent years from a "nice-to-have" to a "must-have" and now to an actual "driver" of the market. On the one hand, there are portfolio adjustments on the seller side against the background of ecological performance. On the other hand, on the buyer side, however, there are now increasingly specific manage-to-green strategies.

While ESG criteria, especially of an ecological nature, have been standard for commercial buildings, particularly in the office sector, for many years, this development became established later in the residential real estate sector. Now, however, ecological considerations are taken into account in almost every real estate transaction. In this case, there are property-specific ecological surcharges or, in most cases, discounts in the pricing. The so-called Brown Discount. The amount of this discount is very asset-specific and difficult to quantify at the market level.

Outlook and strategies in focus

If the mood was better than the situation5 at last year's Expo, the tenor of this year's Expo in Munich could be: The situation is better than the mood. This is certainly not true for all parts of the real estate market, and the construction sector in particular continues to face major challenges. From an investment perspective, however, interesting investment strategies can be developed against the backdrop of the current pricing, provided they do not rely too heavily on the use of debt capital.

Possible strategies can be identified in all sectors. In general, however, it is not the development of the overall market that is the big driver, but rather fundamental analyses of supply and demand, as well as asset specifics. And on the work on the property. Back to the Basics. Back to the Experts.

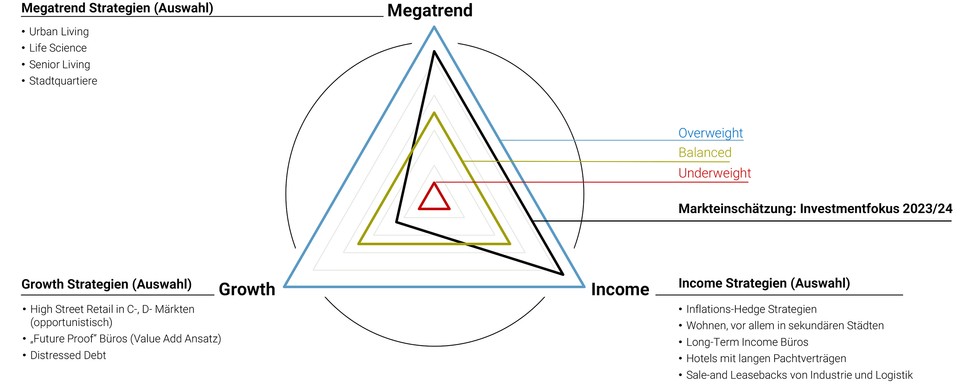

In the following, I have listed various investment strategies in the Lübke Kelber Investment Matrix, which we believe will be the focus of female investors. The investment matrix is composed of the classic fields of IRR driven growth strategies and distribution yield driven income strategies. The latter are generally core and core+ based. As an additional third component of the investment spectrum, we see megatrend driven strategies, which are usually very long-term thinking and focus on structural trends, on megatrends.

Chart 5: Lübke Kelber Investment Matrix 2023 / 2024

(1) See, for example, Trading Economics: Germany Manufacturing PMI - August 2023 Data - 2008-2022 Historical (tradingeconomics.com)

(2) See GFK: Konsumklima weiterhin im Auf und Ab auf niedrigem Niveau (gfk.com)

(3) See OECD: Leading indicators - Composite leading indicator (CLI) - OECD Data

(4) Commerzbank Prognosen, 08.09.2023: GrowthandInflation.pdf (commerzbank.de)

(5) Immobilien Zeitung, 41/22, 13.10.2022: „Die Stimmung ist besser als die Lage“